CGST Notification 02/2020

| Title | Seeks to make amendment (2020) to CGST Rules. |

| Number | 02/2020 |

| Date | 01-01-2020 |

| Download |

G.S.R……(E). -In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

1. (1) These rules may be called the Central Goods and Services Tax (Amendment)Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force on the date of their publication in the Official Gazette.

2. In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), in rule 117,-

(a) in sub-rule (1A), with effect from the 31stDecember 2019, for the figures, letters and word “31stDecember, 2019”, the figures, letters and word “31stMarch, 2020” shall be substituted;

(b) in sub-rule (4), in clause (b), in sub-clause (iii), in the proviso,for the figures, letters and word “31stJanuary, 2020”, the figures, letters and word“30thApril, 2020” shall be substituted.

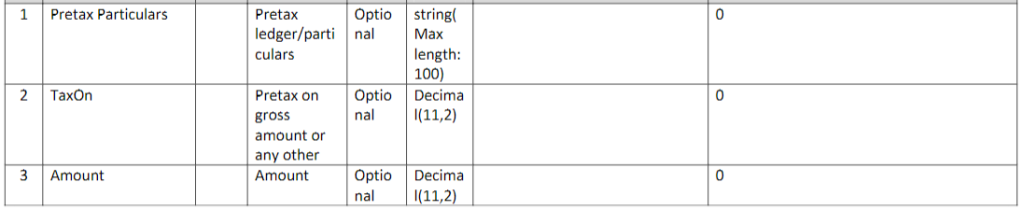

3. In the said rules, in FORM REG-01,in Part-B, for serial numbers12 and 13and the entries relating thereto, the following shall be substituted, namely:-

4. In the said rules, in FORM GSTR-3A,-

(a) in serial number2 under the heading “Notice to Return Defaulter u/s 46 for not filing Return”, for the words “tax liability will” , the words “tax liability may” shall be substituted;

(b) after serial number 4 under the heading “Notice to Return Defaulter u/s 46 for not filing Return” , the following serial number shall be inserted, namely:-

“5. This is a system generated notice and does not require signature.”;

(c) in serial number 3 under the heading “Notice To Return Defaulter U/S 46 For Not Filing Final Return Upon Cancellation Of Registration”, for the words “tax period will”, the words “tax period may” shall be substituted;

(d) after serial number 4 under the heading “Notice To Return Defaulter U/S 46 For Not Filing Final Return Upon Cancellation Of Registration” , the following serial numbershall be inserted, namely:-

“5. This is a system generated notice and does not require signature.”

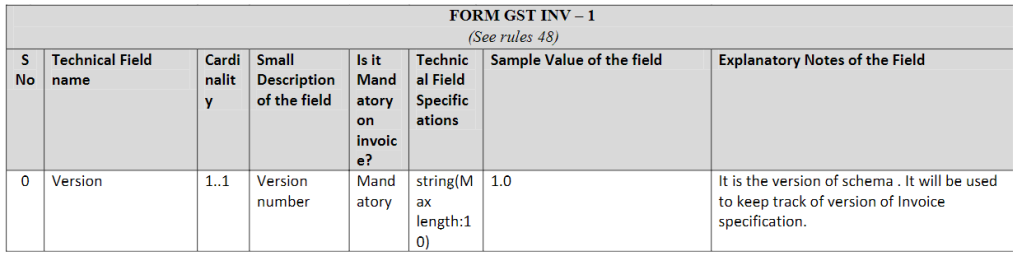

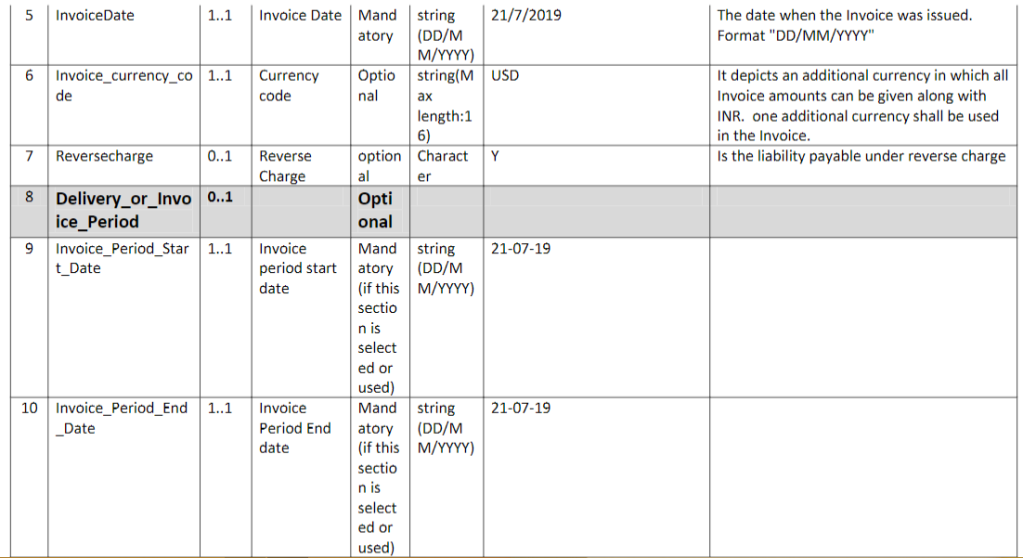

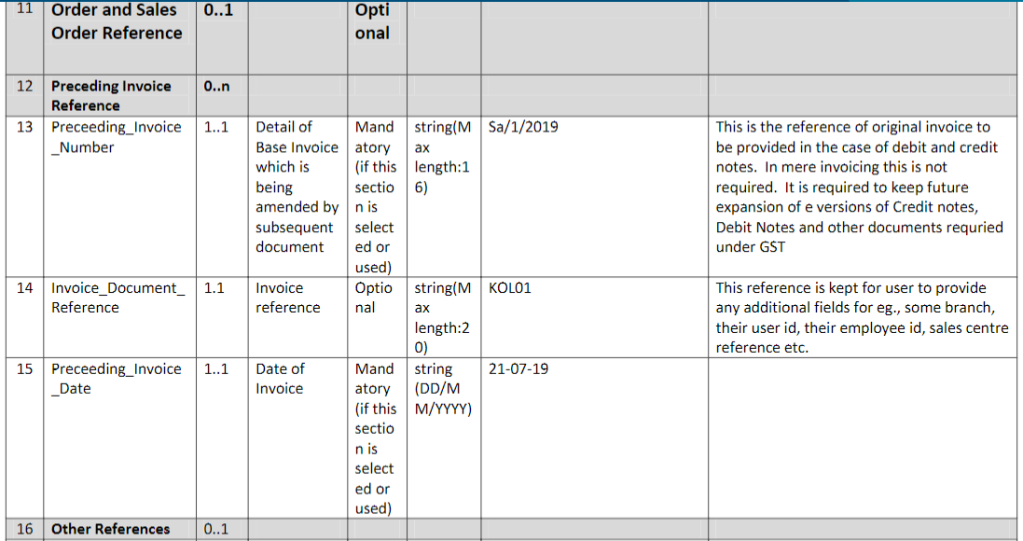

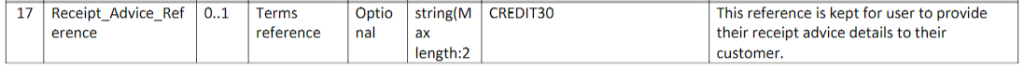

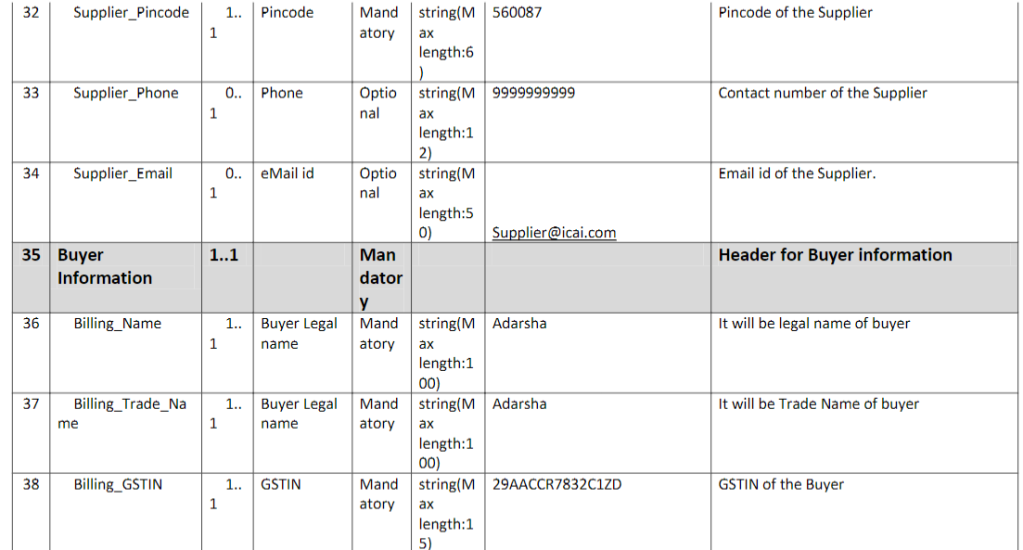

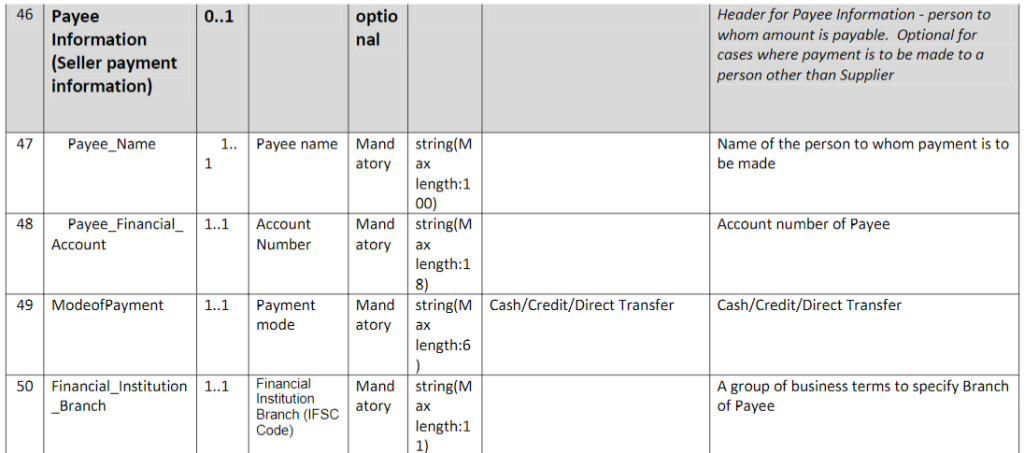

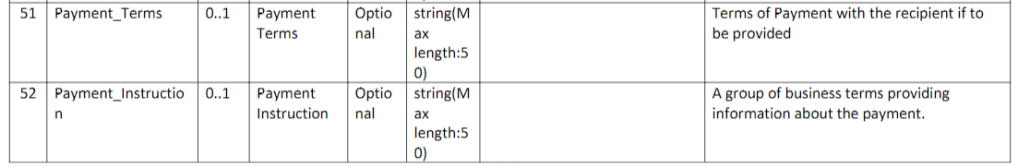

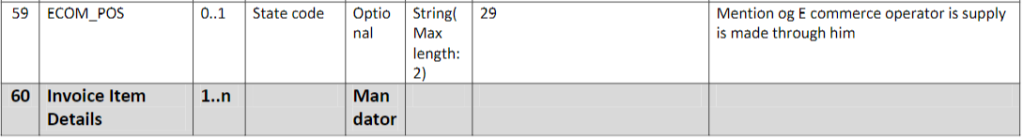

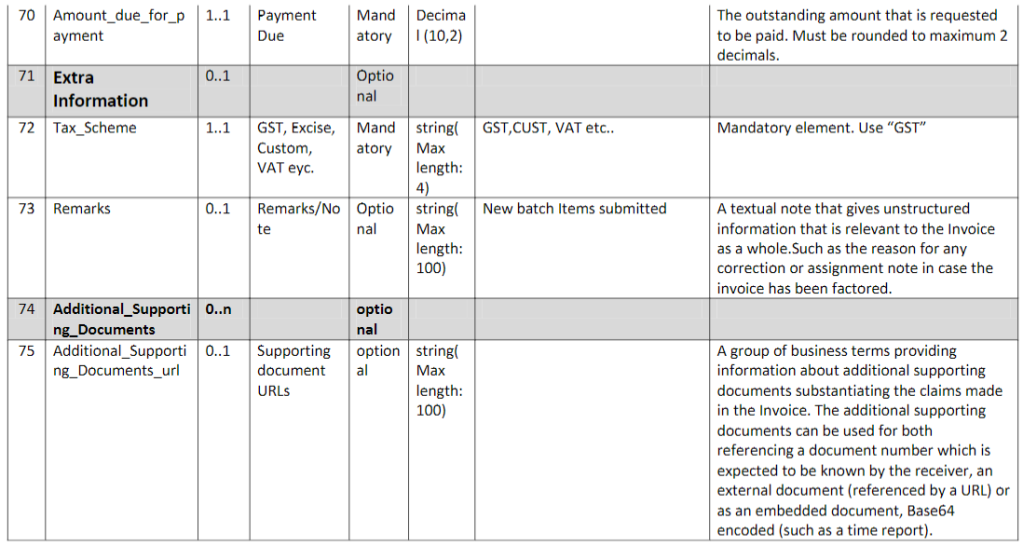

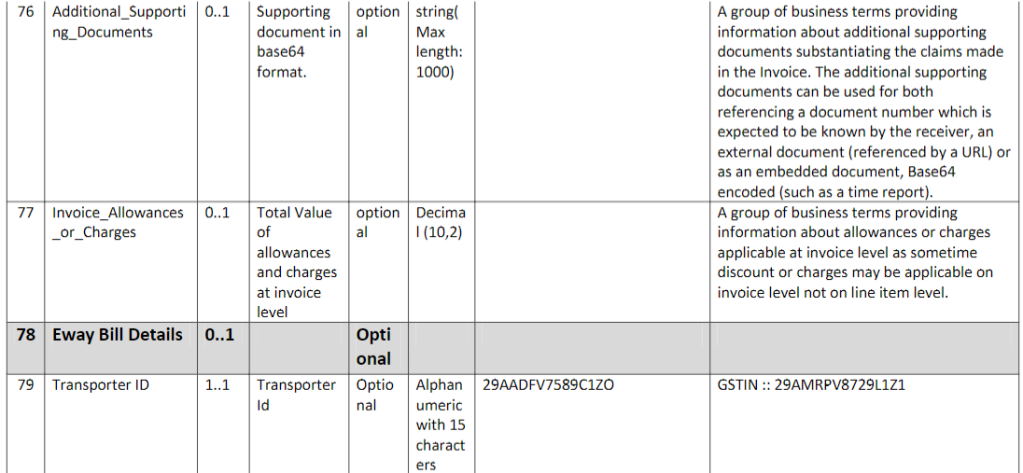

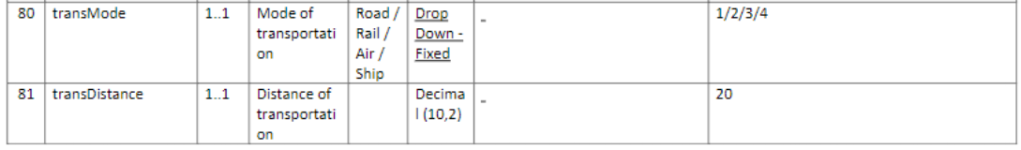

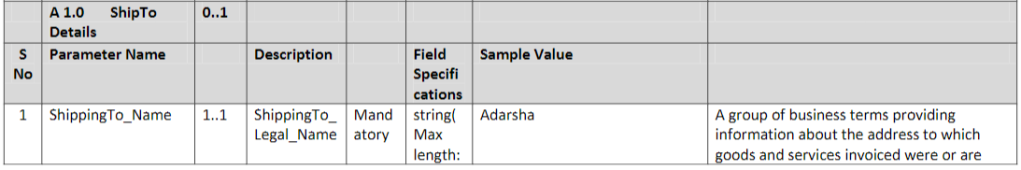

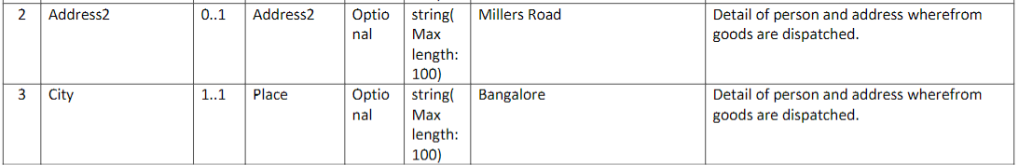

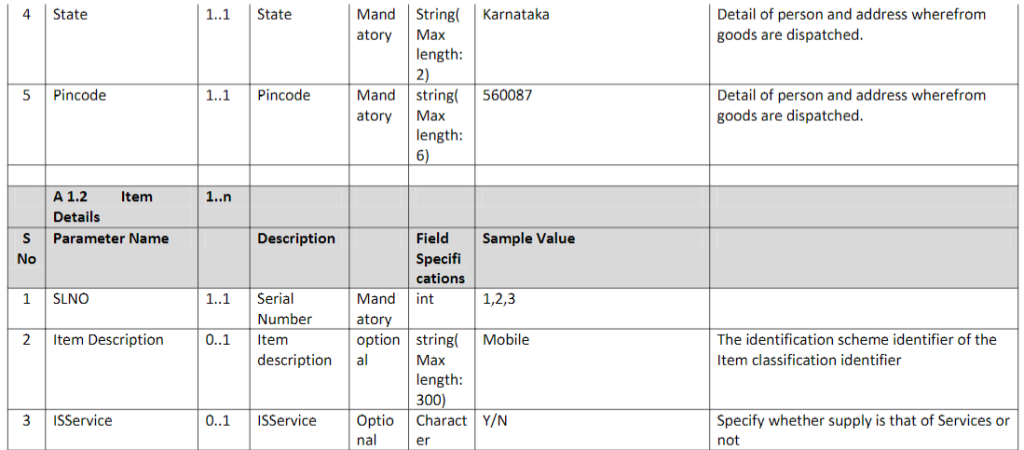

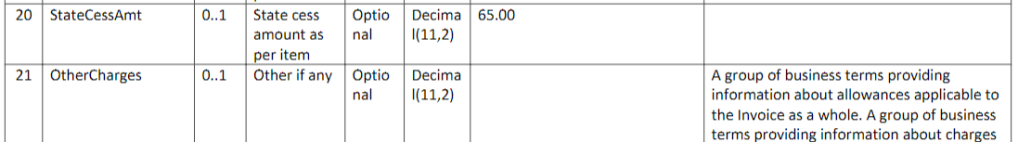

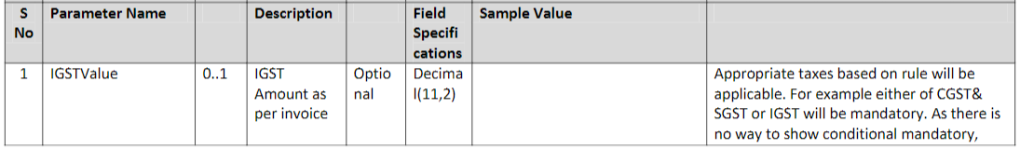

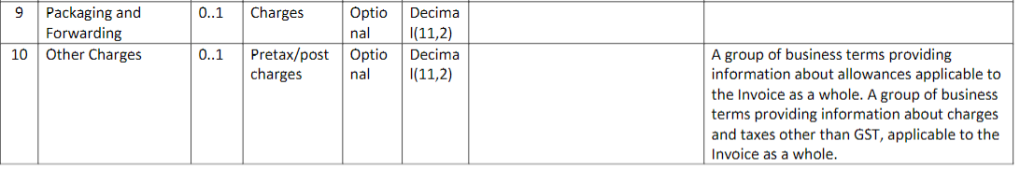

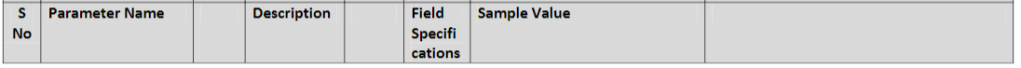

5. In the said rules, for FORM INV-01, the following form shall be substituted, namely:-

“Note: Cardinality Means occurance of field in the schema. Below are the the meaning of various symbol used in this column:

0..1 : It means this item is optional and even if mentioned can not be repeated

1..1: It means that this item is mandatory and can be mentioned only once.

1..n: It means this item is mandatory and can be repeated more than once

0..n: It means this item is optional but can be repated many times. For example: Previous invoice reference is optional but if required one can mention many previous invoice reference.