CGST Notification 60/2020

| Title | Seeks to make Ninth amendment (2020) to CGST Rules |

| Number | 60/2020 |

| Date | 30-07-2020 |

| Download | |

G.S.R…(E). -In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

1. (1) These rules may be called the Central Goods and Services Tax (Ninth Amendment) Rules, 2020.

(2) They shall come into force on the date of their publication in the Official Gazette.

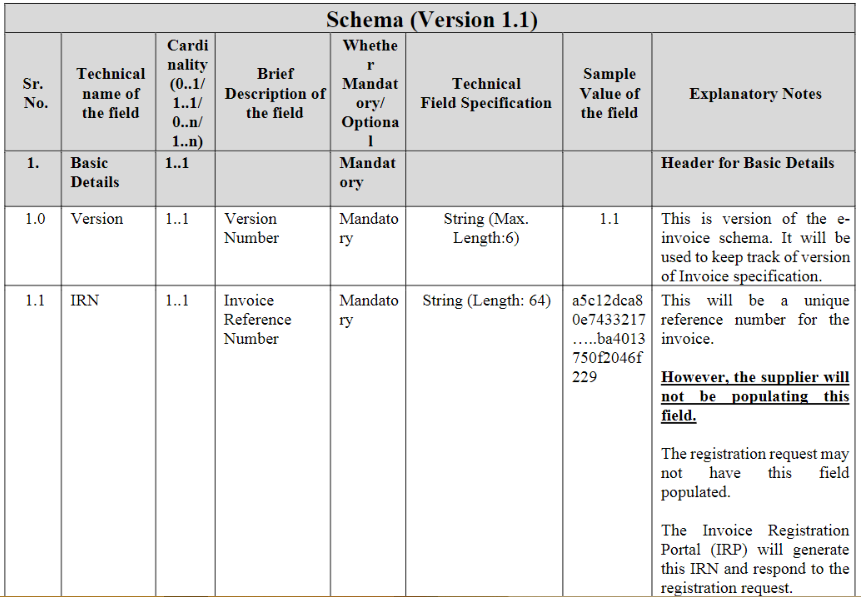

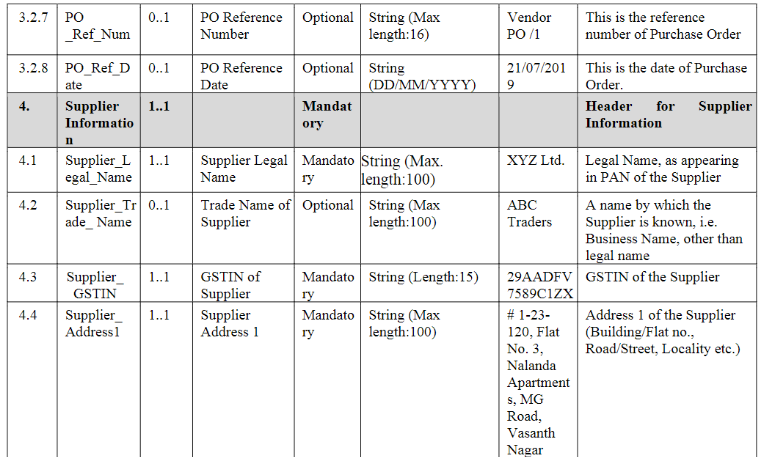

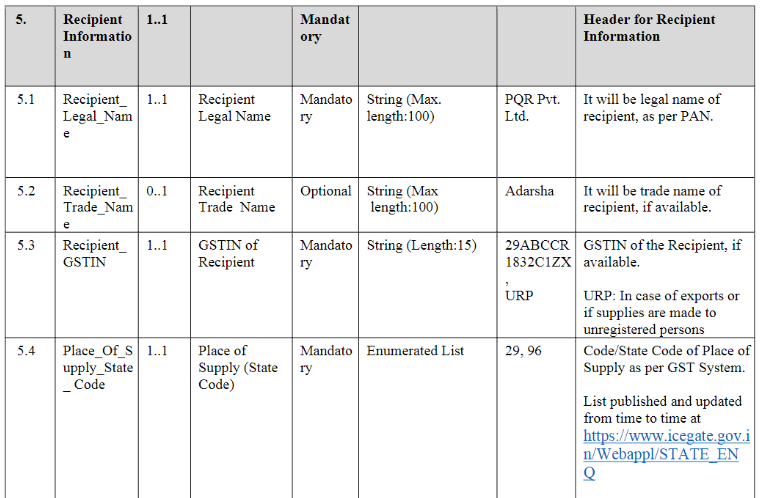

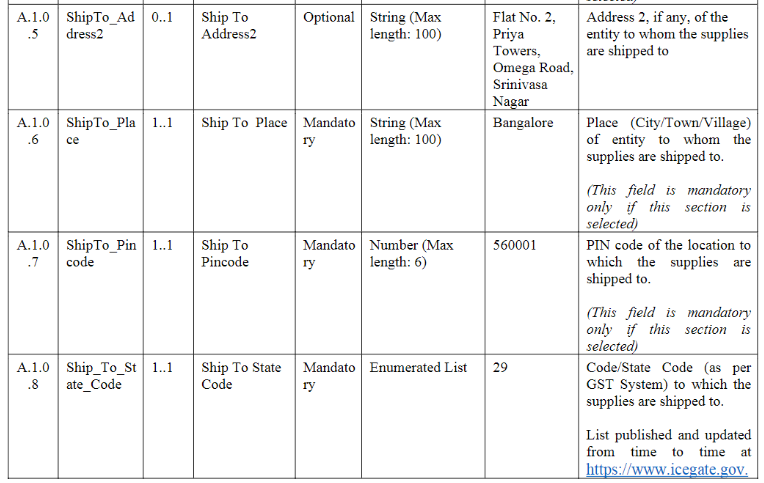

2. In the Central Goods and Services Tax Rules, 2017, for FORM GST INV-01, the following form shall be substituted, namely:-

“FORM GST INV –1

(See Rule 48)

Format/Schema for e-Invoice

Note 1:Cardinality means whether reporting of the item(s) is mandatory or optional as explained below:

0..1: It means that reporting of item is optional and when reported, the same cannot be repeated.

1..1: It means that reporting of item is mandatory but cannot be repeated.1..

1..n: Itmeans that reporting of item is mandatory and can be repeated more than once.

0..n: It means that reporting of item is optional but can be repeated more than once if reported. For example, previous invoice reference is optional but if required one can mention many previous invoice references

Note 2:Field specification Number (Max length: m, n)indicates ‘m’ places before decimal point and ‘n’ places after decimal point. For example, Number (Max length: 3,3) will have the format 999.999