CGST Notification 79/2020

| Title | Seeks to make the Twelfth amendment (2020) to the CGST Rules.2017. |

| Number | 79/2020 |

| Date | 15-10-2020 |

| Download |

G.S.R……(E).-In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on recommendations of the Council,hereby makes the following rules furthertoamend the Central Goods and Services Tax Rules, 2017, namely:-

1.Short title and commencement. -(1) These rules may be called the Central Goods and Services Tax (Twelveth Amendment) Rules, 2020.

(2) Save as otherwise provided in these rules, they shall come into force on the date of their publication in the Official Gazette.

2.In the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as the said rules), in rule 46,for the first proviso, the following proviso shall be substituted, namely:-

“Provided that the Board may, on the recommendations of the Council, by notification, specify-

(i) the number of digits of Harmonised System of Nomenclature code for goods or services that a class of registered persons shall be required to mention; or

(ii) a class of supply of goods or services for which specifiednumber of digits of Harmonised System of Nomenclature code shall berequired to be mentioned by all registered tax payers; and

(iii) the class of registered persons that would not be required to mention the Harmonised System of Nomenclature code for goods or services:”.

3.In the said rules, for rule 67A,the following rule shall be substituted, namely:-

“67A. Manner of furnishing of return or details of outward supplies by short messaging service facility.-Notwithstanding anything contained in this Chapter, for a registered person who is required to furnish a Nil return under section 39 in FORM GSTR-3Bor a Nil details of outward supplies under section 37 in FORM GSTR-1or a Nil statement in FORM GST CMP-08for a tax period, any reference to electronic furnishing shall include furnishing of the said return or the details of outward supplies or statement through a short messaging service using the registered mobile number and the said return or the details of outward supplies or statement shall be verified by a registered mobile number based One Time Password facility. Explanation. -For the purpose of this rule, a Nil return or Nil details of outward supplies or Nil statement shall mean a return under section 39 or details of outward supplies under section 37 or statement under rule 62, for a tax period that has nil or no entry in all the Tables in FORM GSTR-3Bor FORM GSTR-1or FORM GST CMP-08, as the case may be.”.

4.In the said rules, in rule 80, in sub-rule(3), for the proviso, the following proviso shall be substituted, namely:

-“Provided that for the financial year 2018-2019 and 2019-2020,every registered person whose aggregate turnover exceeds five crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9Cfor the said financial year, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.”

5.In the said rules, with effect from the 20thday of March, 2020, in rule 138E,afterthe third proviso, the following proviso shall be inserted, namely:-

“Provided also that the said restriction shall not apply during the period from the 20thday of March, 2020 till the 15thdayof October, 2020 in case where the return in FORM GSTR-3Bor the statement of outward supplies in FORM GSTR-1or the statement in FORM GST CMP-08, as the case may be, has not been furnished for the period February, 2020 to August, 2020.”

6.In the said rules, in rule 142, in sub-rule (1A),-

(i) for the words “proper officer shall”, the words “proper officer may” shall be substituted;

(ii) for the words “shall communicate”, the word “communicate” shall be substituted.

7. In the said rules, in FORM GSTR-1,againstserial number 12, in the Table, in column 6, in the heading, for the words “Total value”, the words “Rate of Tax” shall be substituted.

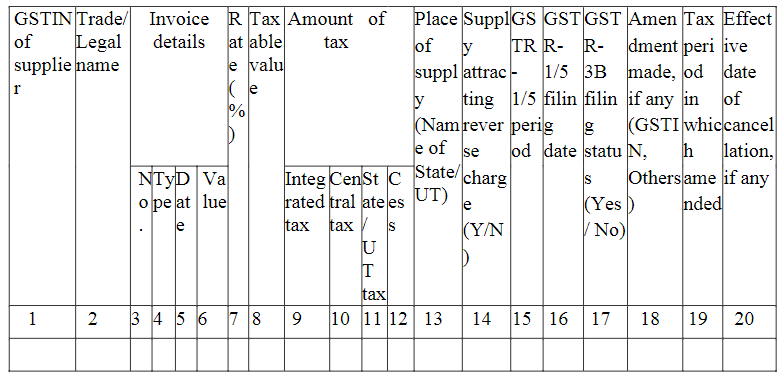

8. In the said rules, for FORM GSTR-2A, the following form shall be substituted, namely: –

FORM GSTR-2A

[See rule 60(1)]

PART A

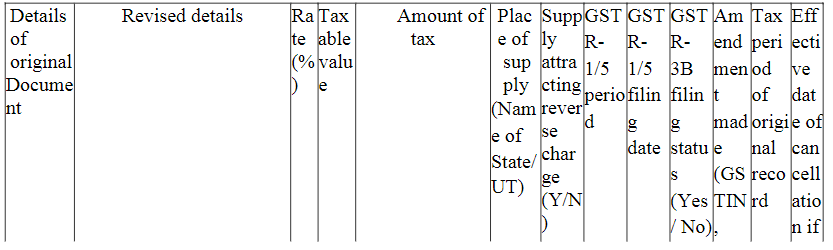

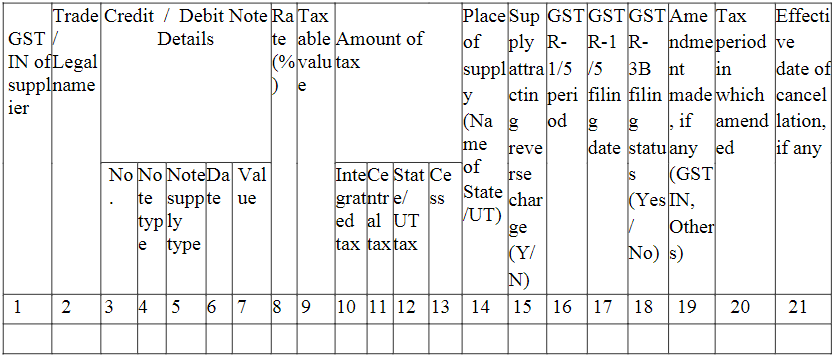

3. Inward supplies received from a registered person including supplies attracting reverse charge

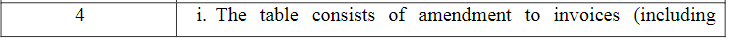

4. Amendment to Inward supplies received from a registered person including supplies attracting reverse charge (Amendment to 3)

5. Debit / Credit notes received during current tax period

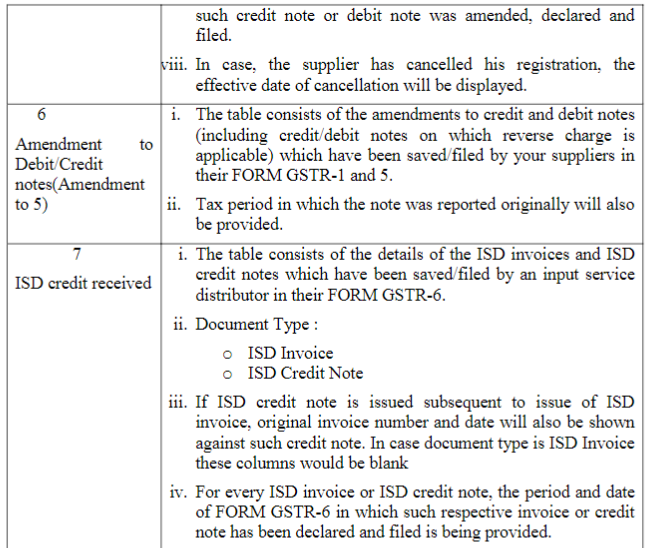

6. Amendment to Debit / Credit notes (Amendment to 5)

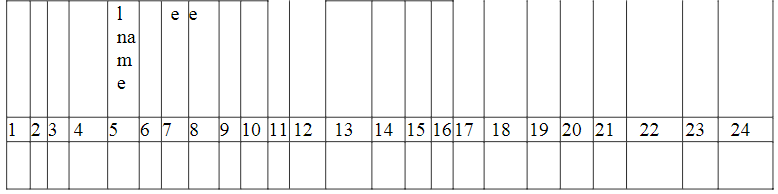

PART B

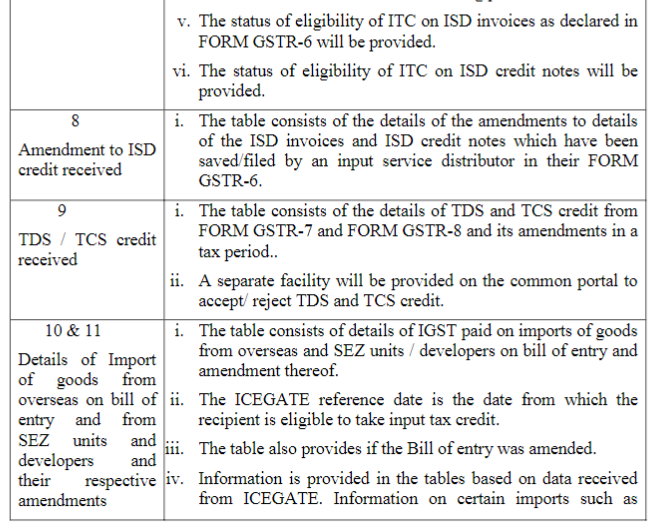

7. ISD credit received

8. Amendments to ISD credit details

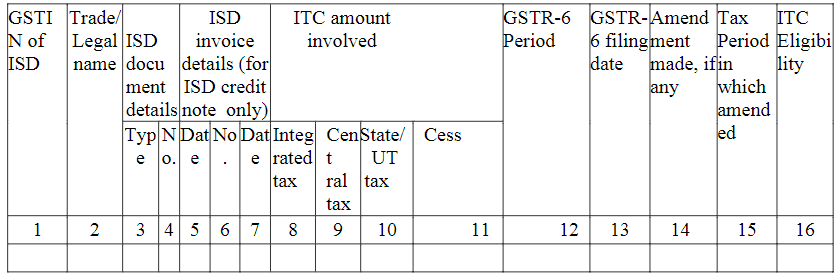

PART-C

9. TDS and TCS Credit (including amendments thereof) received

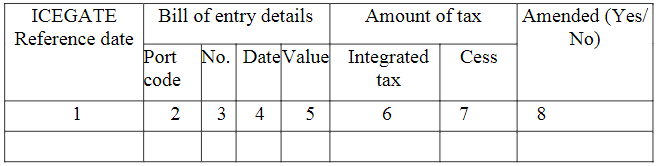

PART-D

10. Import of goods from overseas on bill of entry (including amendments thereof

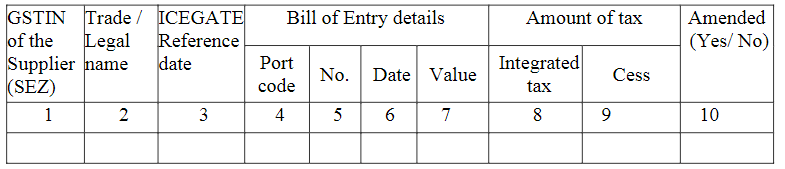

11. Inward supplies of goods received from SEZ units / developers on bill of entry (including amendments thereof)

Instructions:

1. Terms Used :-

a. ITC –Input tax credit

b. ISD –Input Service Distributor

2. Important Advisory: FORM GSTR-2A is statement which has been generated on the basis of the information furnished by your suppliers in their respective FORMS GSTR-1,5,6,7 and 8. It is a dynamic statement and is updated on new addition/amendment made by your supplier in near real time. The details added by supplier would reflect in corresponding FORM GSTR-2A of the recipient irrespective of supplier’s date of filing.

3. There may be scenarios where a percentage of the applicable rate of tax rate may be notified by the Government. A separate column will be provided for invoices / documents where such rate is applicable.

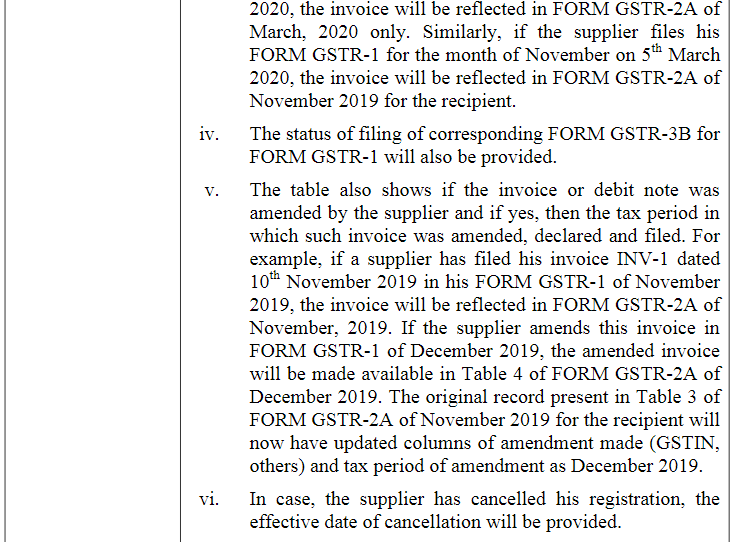

4.Table wise instructions:

9.In the said rules, in FORM GSTR-5,-

(i) in the table, –

(a) in serial number 2, after entry (c), the following entries shall be inserted, namely:-

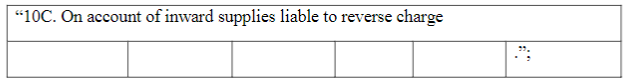

(b) in serialnumber10,-

(A) in the heading, after the words, “Total tax liability”, the brackets and words “(including reverse charge liability, if any)”, shall be inserted;

(B) after serial number10Band the entry relating there to ,the following serial number and entry shall be inserted, namely,- after the words, “Total tax liability”, thebrackets andwords “(including reverse charge liability, if any)”, shall be inserted;(A) in the heading, after the words, “Total tax liability”, the brackets and words “(including reverse charge liability, if any)”, shall be inserted;

(ii) in the instructions,-

(a) for paragraph 7, the following paragraph shall be substituted, namely:-

” 7. Invoice-level information, rate-wise, pertaining to the tax period should be reported as under:

(i.) for all B to B supplies (whether inter-State or intra-State), invoice level details should be uploaded in Table 5;

(ii.) for all inter-state B to C supplies, where invoice value is more than Rs. 2,50,000/-(B to C Large) invoice level detail to be provided in Table 6; and

(iii.) for all B to C supplies, other than those reported in table 6, shall be reported in Table 7 providing State-wise summary of such supplies.”;

(b) in paragraph 8, in clause (ii), after the words, “invoice value is more than”, the word “rupees”, shall be inserted;

(c) for paragraph 10, the following paragraph shall be substituted, namely: -“10. Table 10 consists of tax liability on account of outward supplies declared in the current tax period and negative ITC on account of amendment to import of goods in the current tax period. Inward supplies attracting reverse charge shall be reported in Part C of the table.”.

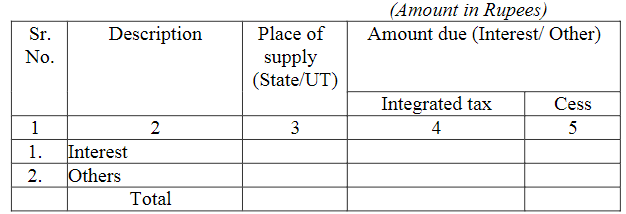

10. In the said rules, in FORM GSTR-5A,-

(i) against serial number 4and entries relating thereto, the following entries shall be inserted, namely:-

“4(a) ARN:

4(b) Date of ARN:”;

(ii) for serial number 6, the following shall be substituted, namely: –

“6. Calculation of interest, or any other amount

(iii). for serial number 7, the following shall be substituted, namely:-

“7. Tax, interest and any other amount payable and paid

11.In the said rules, in FORM GSTR-9, –

(i) in the Table, –

(a) against serial number 8C,in column 2, for the entry, the following entry shall be substituted, namely:-

“ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during the financial year but availed in the next financial year up to specified period”;

(b) against Pt. V, for the heading, the following heading shall be substituted, namely:-

“Particulars of the transactions for the financial year declared in returns of the next financial year tillthe specified period.”

(ii) in the instructions,-

(a) after paragraph 2, the following entry shall be inserted, namely,-

2A. In the Table, against serial numbers4,5,6 and 7, the taxpayers shall report the values pertaining to the financial year only. The value pertaining to the preceding financial year shall not be reported here.”

(b) in paragraph 4, –

(A) after the words, letters and figures, “that additional liability for the FY 2017-18 or FY 2018-19”, the word, letters and figures “or FY 2019-20” shall be inserted

(B) in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(c) in paragraph 5, in the Table, in second column, –

(A) against serial number 6B, after the entries, the following entry shall be inserted, namely: –

“For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(B) against serial number 6C and serial number 6D, –

(i) after the entry ending with the words “entire input tax credit under the “inputs” row only.”, the following entry shall be inserted, namely: –

“For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(ii) in the entry ending with the words, figures and letters “Table 6C and 6D in Table 6D only.”, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(C) against serial number 6E, after the entry, the following entry shall be inserted, namely:

” For FY 2019-20, the registered person shall report the breakup of input tax credit as capital goods and have an option to either report the breakup of the remaining amount as inputs and input services or report the entire remaining amount under the “inputs” row only.”;

(D) against serial number 7A, 7B, 7C, 7D, 7E, 7F, 7G and 7H, in the entry, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.;

(E) against serial number 8A, after the entry, the following entry shall be inserted, namely: –

“For FY 2019-20, it may be noted that the details from FORM GSTR-2Agenerated as on the 1st November, 2020 shall be auto-populated in this table.”;

(F) against serial number 8C, for the entries, the following entry shall be substituted, namely:-

“Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes supply of services received from SEZs) received during the financial year for which the annual return is being filed for but credit on which was availed in the next financial year within the period specified under Section 16(4) of the CGST Act, 2017.”

(d) in paragraph 7,-

(A) after the words and figures “April 2019 to September 2019.”, the following shall be inserted, namely: –

“For FY 2019-20, Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3Bbetween April 2020 to September 2020.”;

(B) in the Table, in second column, –

(I) against serial number 10 & 11, after the entries, the following entry shall be inserted, namely: –

“For FY 2019-20, Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1of April 2020 to September 2020 shall be declared here.”

(II) against serial number 12, –

(1) in the entry beginning with the word, letters and figures “For FY 2018-19” after the words “for filling up these details.”, the following entry shall be inserted, namely: –

“For FY 2019-20, Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 2020 to September 2020 shall be declared here. Table 4(B) of FORM GSTR-3Bmay be used for filling up these details. For FY 2019-20, the registered person shall have an option to not fill this table.”;

(2) in the entry beginning with the word, letters and figures “For FY 2017-18” and ending with the words “an option to not fill this table.”, for the letters, figures and word“ FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(III) against serial number 13, –

(1) in the entry beginning with the word, letters and figures “For FY 2018-19” after the words, letters and figures “in the annual return for FY 2019-20.”, the following entry shall be inserted, namely: –

“For FY 2019-20, Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April 2020 to September 2020 shall be declared here. Table 4(A) of FORM GSTR-3Bmay be used for filling up these details. However, any ITC which was reversed in the FY 2019-20 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2020-21, the details of such ITC reclaimed shall be furnished in the annual return for FY 2020-21.”;

(2) in the entry beginning with the word, letters and figures “For FY 2017-18” and ending with the words “an option to not fill this table.”, for the letters, figures and word “FY 2017-18 and 2018-19”, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(e) in paragraph 8, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.

12. In the said rules, in FORM GSTR-9C, in the instructions, –

(i) in paragraph 4, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted;

(ii) in paragraph 6, in the Table, in second column, for the letters, figures and word “FY 2017-18 and 2018-19” wherever they occur, the letters, figures and word “FY 2017-18, 2018-19 and 2019-20” shall be substituted.

13. In the said rules, in FORM GST RFD-01, in Annexure-1, in Statement-2, in the heading the brackets, word and letters“(accumulated ITC)”, shall be omitted.

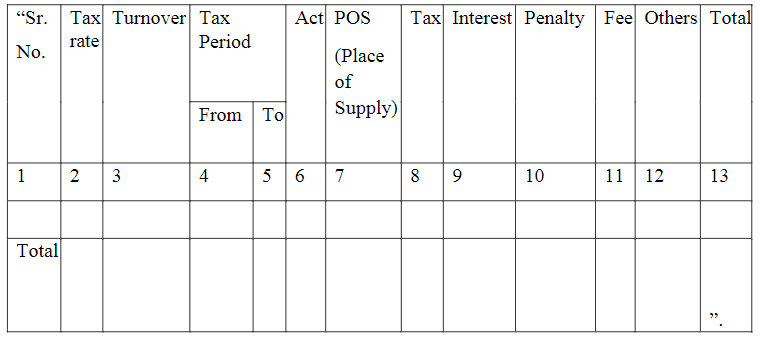

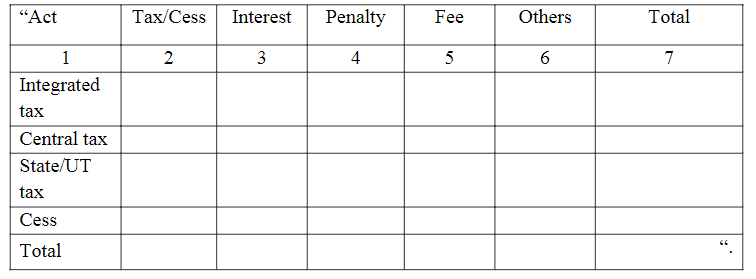

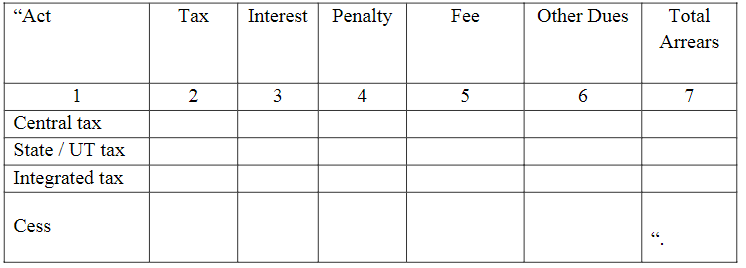

14. In the said rules, in FORM GST ASMT-16, for the table, the following table shall be substituted, namely:-

15. In the said rules, in FORM GSTDRC-01, after entry (c),for the table, the following table shall be substituted, namely: –

16. In the said rules, in FORM GST DRC-02, after entry (c), for the table, the following table shall be substituted, namely: –

17. In the said rules, in FORM GST DRC-07, after serial number 5, for the table, the following table shall be substituted, namely: –

18. In the said rules, in FORM GST DRC-08, after serial number 7,for the table, the following table shall be substituted, namely: –

19. In the said rules, in FORM GST DRC-09, for the table, the following table shall be substituted, namely: –

20. In the said rules, in FORM GST DRC-24, for the table, the following table shall be substituted, namely:-

21. In the said rules, in FORM GST DRC-25, for the table, the following table shall be substituted, namely:-

13. In the said rules, in FORM GST RFD–01, in Annexure–1, in Statement–2, in the heading thebrackets,word and letters“(accumulated ITC)”, shall be omitted

(I)against serial number 10 & 11, after the entries, the following entry shall be inserted, namely: –

(iii). for serial number 7, the following shall be substituted, namely:

PART B