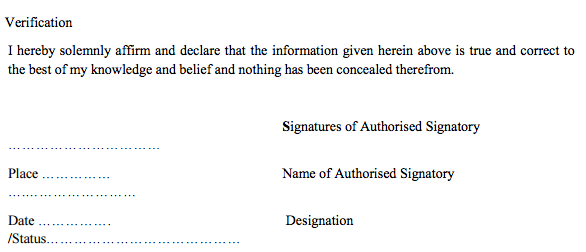

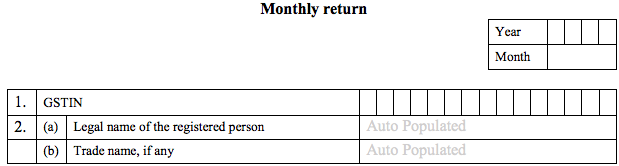

FORM GSTR-3

Monthly return

- FORM GSTR-3

- Monthly return

- FORM GSTR-3 PDF link

- Part-A (To be auto populated)

- (3) Turnover

- (4) Outward supplies

- (4.1) Inter-State supplies (Net Supply for the month)

- (4.2) Intra-State supplies (Net supply for the month)

- (4.3) Tax effect of amendments made in respect of outward supplies

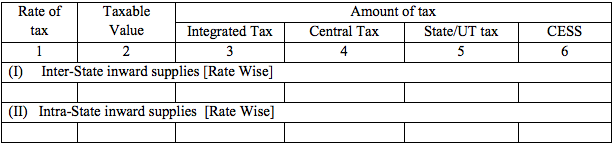

- (5) Inward supplies attracting reverse charge including import of services

- (5A) Inward supplies on which tax is payable on reverse charge basis

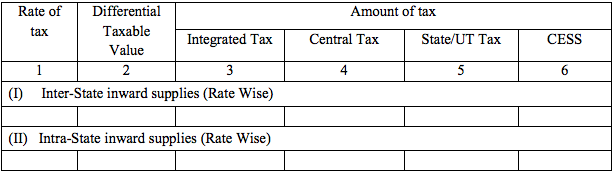

- (5B) Tax effect of amendments in respect of supplies attracting reverse charge

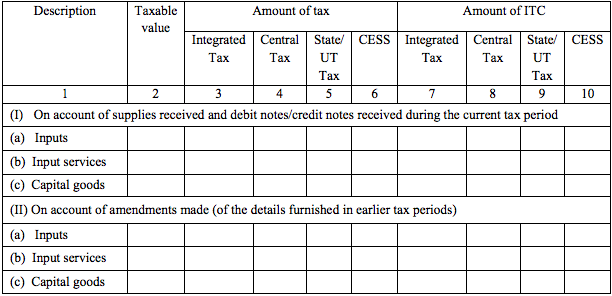

- (6) Input tax credit

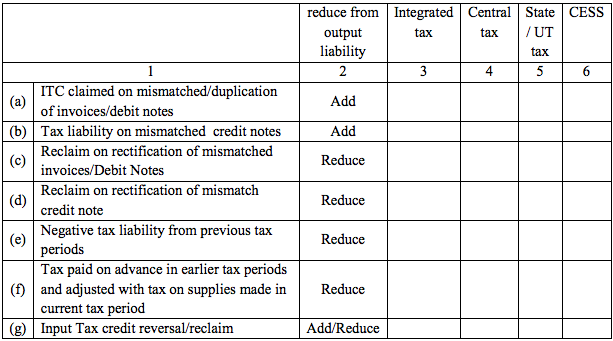

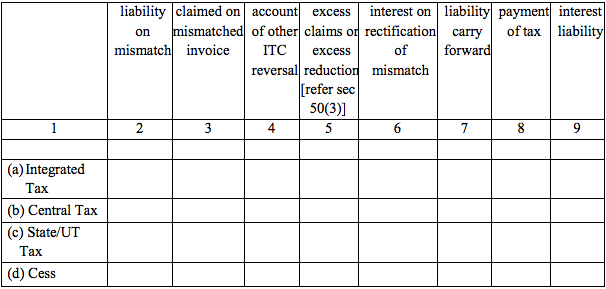

- (7) Addition and reduction of amount in output tax for mismatch and other reasons

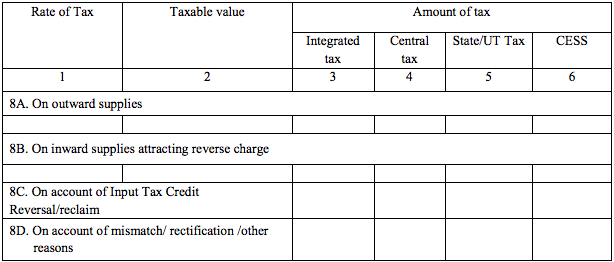

- (8) Total tax liability

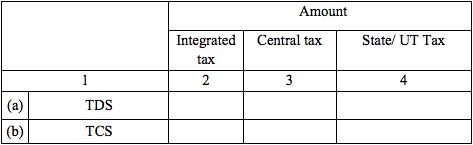

- (9) Credit of TDS and TCS

- (10) Interest liability (Interest as on ……………)

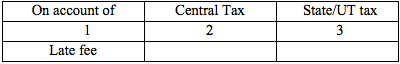

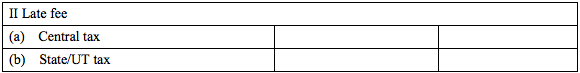

- (11) Late Fee

- Part B

- Monthly return

FORM GSTR-3 PDF link

(1) Terms Used :-

a) GSTIN :- Goods and Services Tax Identification Number

b) TDS :- Tax Deducted at source

c) TCS :- Tax Collected at source

(2) GSTR 3 can be generated only when GSTR-1 and GSTR- 2 of the tax period

have been filed.

(3) Electronic liability register, electronic cash ledger and electronic

credit ledger of

taxpayer will be updated on generation of GSTR-3 by taxpayer.

(4) Part-A of GSTR-3 is auto-populated on the basis of GSTR 1, GSTR 1A and

GSTR 2.

(5) Part-B of GSTR-3 relates to payment of tax, interest, late fee etc. by

utilising credit

available in electronic credit ledger and cash ledger.

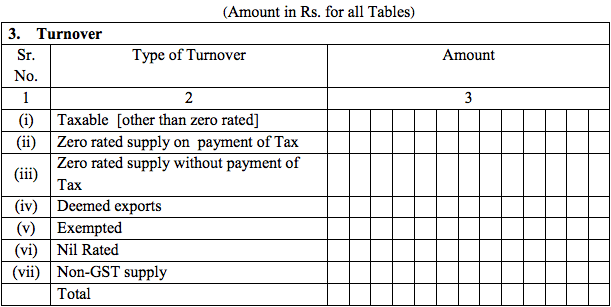

Part-A (To be auto populated)

(3) Turnover

(4) Outward supplies

(1) Tax liability relating to outward supplies in Table 4 is net of

invoices, debit/credit

notes and advances received.

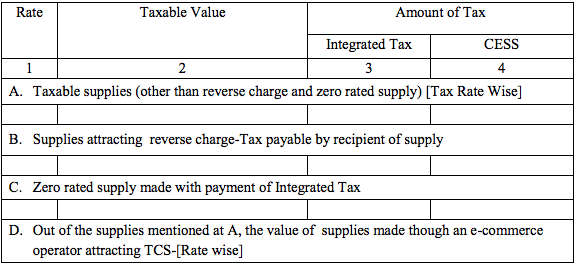

(4.1) Inter-State supplies (Net Supply for the month)

(1) Table 4.1 will not include zero rated supplies made without payment of

taxes.

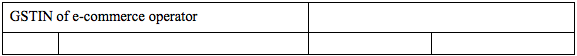

(4.2) Intra-State supplies (Net supply for the month)

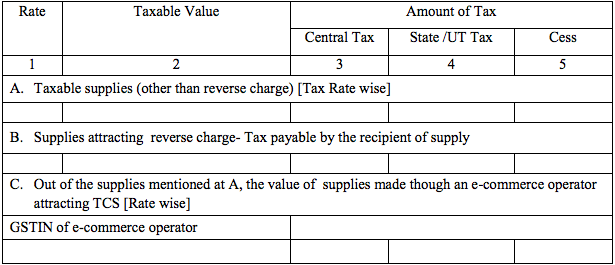

(4.3) Tax effect of amendments made in respect of outward supplies

(1) Table 4.3 will not include amendments of supplies originally made under

reverse charge basis.

(5) Inward supplies attracting reverse charge including import of services

(Net of advance adjustments)

(1) Tax liability due to reverse charge on inward supplies in Table 5 is net of

invoices, debit/credit notes, advances paid and adjustments made out of tax paid on

advances earlier.

(2) Utilization of input tax credit should be made in accordance with the

provisions of

section 49.

(3) GSTR-3 filed without discharging complete liability will not be treated

as valid return.

(4) If taxpayer has filed a return which was not valid earlier and later

on, he intends to

discharge the remaining liability, then he has to file the Part B of GSTR-3

again.

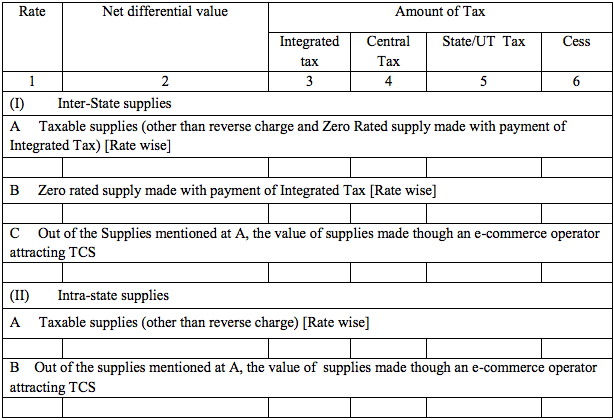

(5A) Inward supplies on which tax is payable on reverse charge basis

(5B) Tax effect of amendments in respect of supplies attracting reverse charge

(6) Input tax credit

ITC on inward taxable supplies, including imports and ITC received from ISD[Net

of debit notes/credit notes]

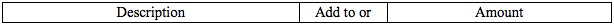

(7) Addition and reduction of amount in output tax for mismatch and other reasons

(8) Total tax liability

(9) Credit of TDS and TCS

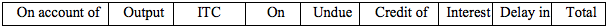

(10) Interest liability (Interest as on ……………)

(11) Late Fee

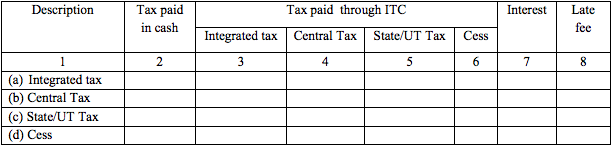

Part B

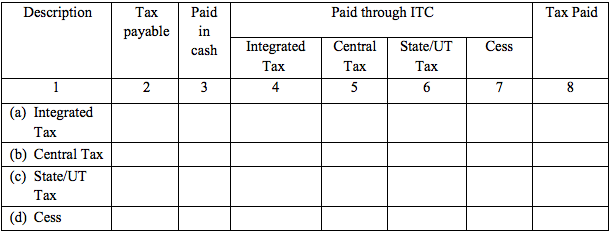

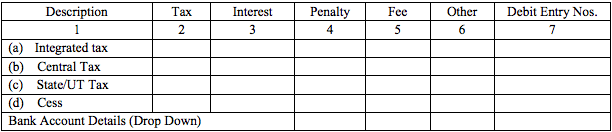

(12) Tax payable and paid

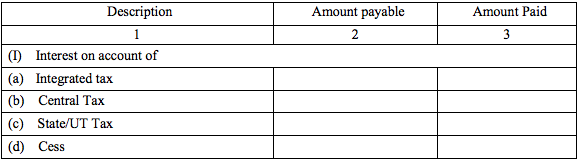

(13) Interest, Late Fee and any other amount (other than tax) payable and paid

(14) Refund claimed from Electronic cash ledger

Refund claimed from cash ledger through Table 14 will result in a debit

entry in electronic cash ledger on filing of valid GSTR 3.

(15) Debit entries in electronic cash/Credit ledger for tax/interest payment [to be populated after payment of tax and submissions of return]