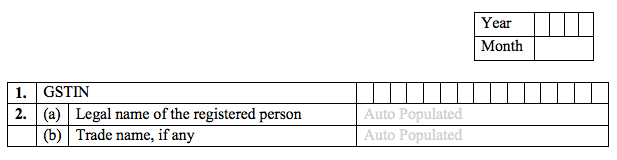

FORM GSTR 8

Statement for tax collection at source

- FORM GSTR 8

- Statement for tax collection at source

- FORM GSTR-8 PDF link

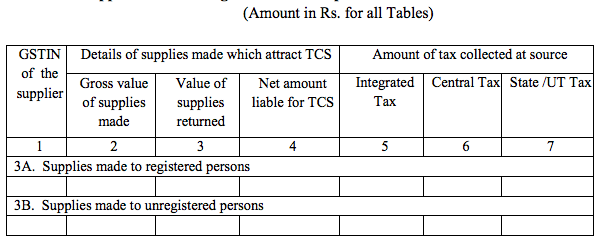

- 3. Details of supplies made through e-commerce operator

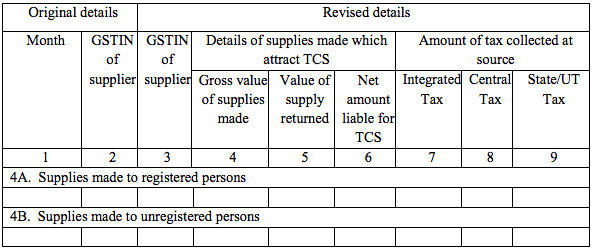

- 4. Amendments to details of supplies in respect of any earlier statement

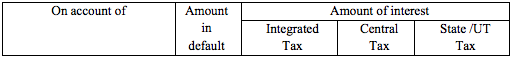

- 5. Details of interest

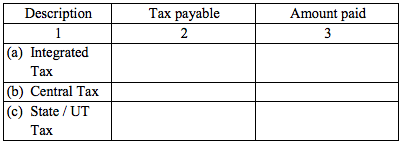

- 6. Tax payable and paid

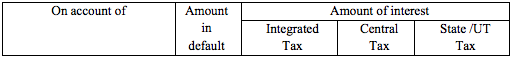

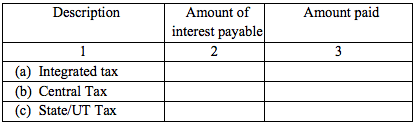

- 7. Interest payable and paid

- 8. Refund claimed from electronic cash ledger

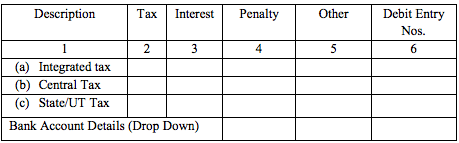

- 9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return]

- Statement for tax collection at source

FORM GSTR-8 PDF link

Instructions:-

1) Terms Used :-

-

GSTIN :- Goods and Services Tax Identification Numbe.

-

TCS :- Tax Collected at source

2) An e-commerce operator can file GSTR- 8 only when full TCS liability has been discharged.

3) TCS liability will be calculated on the basis of table 3 and table 4.

4) Refund from electronic cash ledger can only be claimed only when all the TCS liability for that tax period has been discharged.

5) Cash ledger will be debited for the refund claimed from the said ledger.

6) Amount of tax collected at source will flow to Part C of GSTR- 2A of the taxpayer on filing of GSTR-8.

7) Matching of Details with supplier‘s GSTR-1 will be at the level of GSTIN of supplier.

3. Details of supplies made through e-commerce operator

4. Amendments to details of supplies in respect of any earlier statement

5. Details of interest

6. Tax payable and paid

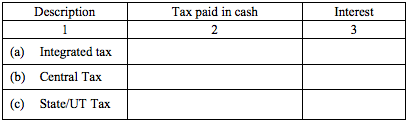

7. Interest payable and paid

8. Refund claimed from electronic cash ledger

9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return]