Handling an Invoice sent incorrectly to a different recipient

For Instance, Supplier A has issued a hard-copy paper invoice to Recipient B, but has wrongly reported to the Government Portal that the Invoice is for Recipient C.

The user (Recipient B) is unable to show this Invoice in their GSTR-2 Tax Return of Inward Supplies. Therefore they are unable to claim Input Tax Credit (ITC).

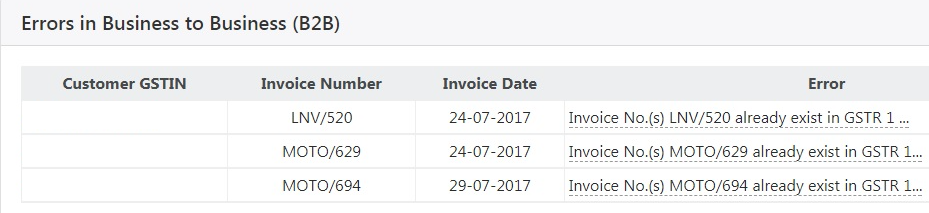

The error message from the Government Portal is shown here

Recommendation

There is no direct solution through the GSTN Government Portal. We recommend the following steps

- Pick the phone and call the Supplier

- Request them to call Recipient C (the wrong recipient) to Reject the Invoice

- Recipient B can upload an Invoice with a slightly different number with the same details

- The supplier can then accept this Invoice

- This will ensure that Recipient C gets credit this tax period (month)