What is the need for a Consolidated Year-to-Date Report?

In the technology-enabled GST Regime, the Government is already

talking about applying data analytics to compare GSTR-1 Sales

returns and GSTR-2A Purchase returns with data reported in GSTR-3B Returns.

Also, the Government intends to compare Income Tax Returns (Direct Taxes)

with GST Returns (Indirect Taxes).

It is useful for every tax payer to have a year-to-date summary of their

various GST Returns and monitor them for inconsistencies and take

corrective action sooner, rather than later.

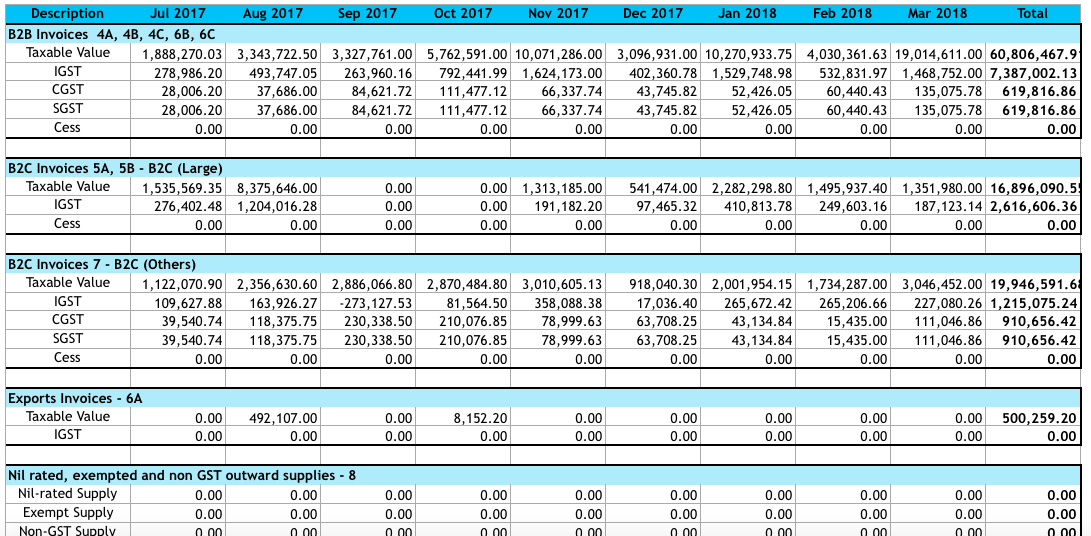

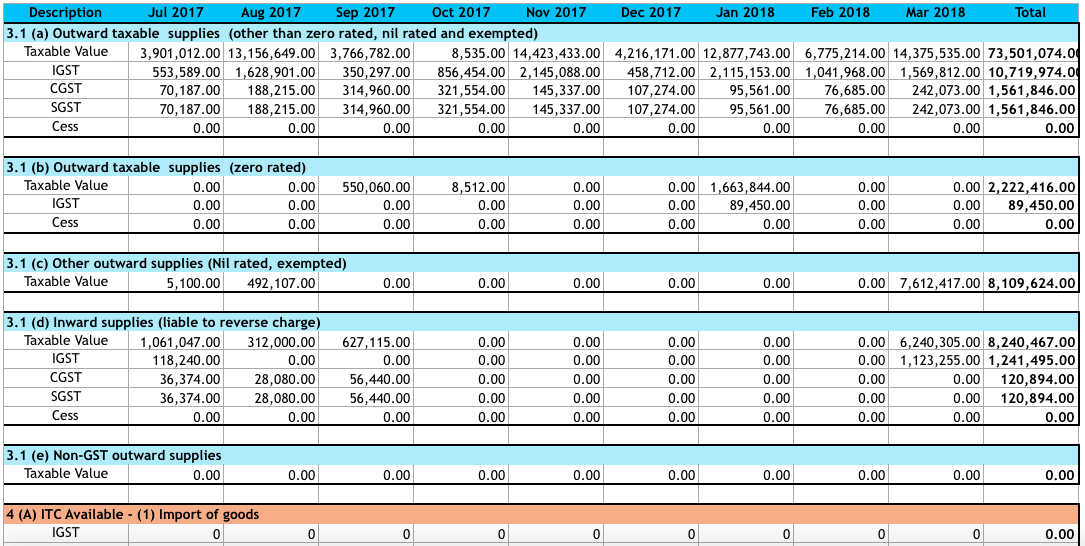

Here are screen shots of the GSTR-1 and GSTR-3B consolidated reports.

GSTR-1 Consolidated Report

GSTR-3B Consolidated Report

How to Download Consolidated Year-to-Date reports using GSTZen?

The video below explains the various steps to Download Consolidated Year-to-Date reports using GSTZen

If you are a Tax Consultant, you can upload Invoices for multiple clients

(GSTINs) in bulk using GSTZen. Signup

now.