E-Way Bill generation for various scenarios

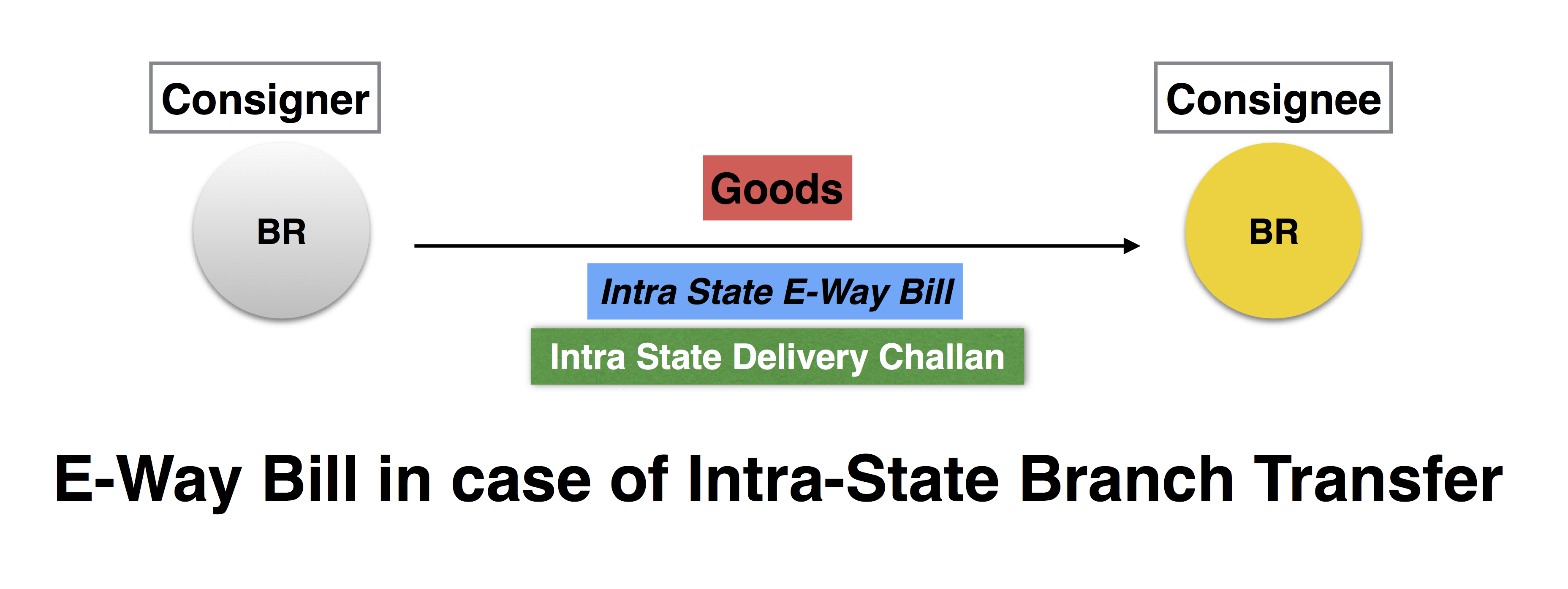

How should one generate E-Way bill for Branch Transfer within the same State, say Bihar (BR) to Bihar (BR)?

To effect a Branch Transfer of goods, the Registered Taxpayer must issue an

Intra-State Delivery Challan (CGST+SGST) and create an E-Way Bill against

that Delivery Challan.

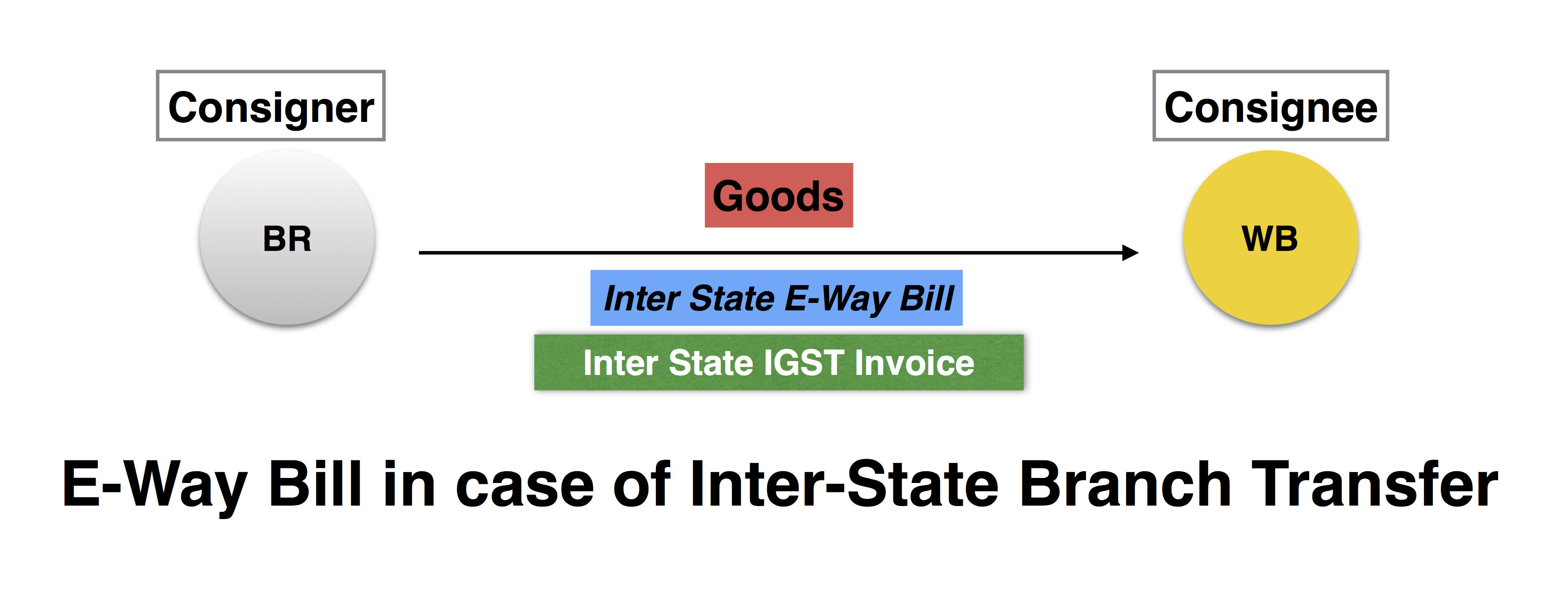

How should one generate E-Way bill for movement of goods due to Branch Transfer from the state of Bihar to the state of West Bengal?

The movement of goods across states is a taxable supply and must be

accompanied with an Inter-State Tax Invoice (IGST).

To effect a Branch Transfer of goods, the Registered Taxpayer in Bihar in

must issue an IGST Invoice to the Registered Taxpayer in West Bengal and

create an E-Way Bill against that Invoice.

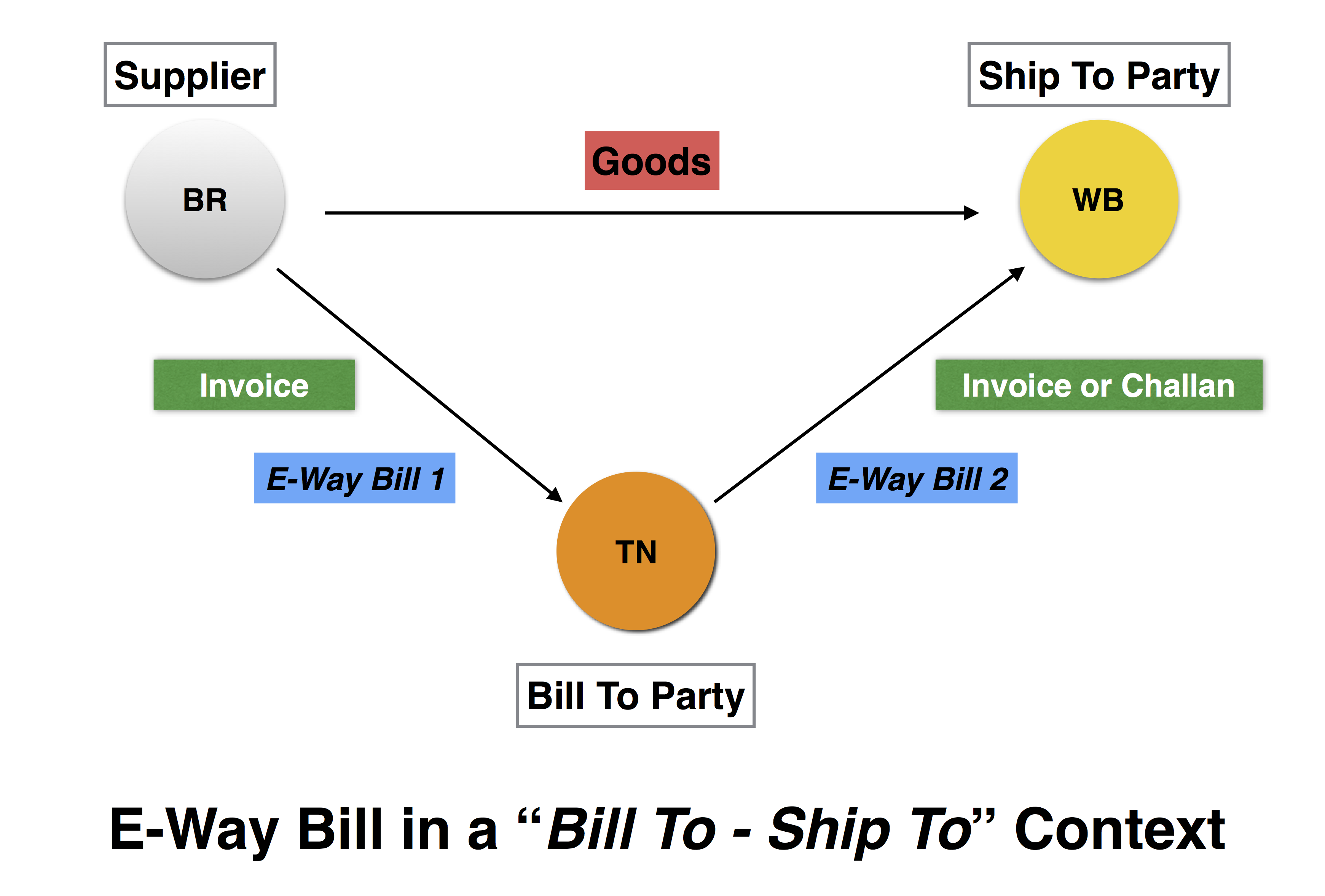

Question: How are E-Way Bills generated for movement of goods in a “Bill-To Ship-To” transaction? As an example, say a Registered Supplier in Bihar is Billing to a Recipient in Tamil Nadu and Shipping to a Consignee in West Bengal. What should be done in this situation?

Two E-Way Bills must be generated in this situation.

First, the Bihar Supplier will issue an Inter-State Tax Invoice (IGST) to

the Tamil Nadu Recipient with Place of Supply Tamil Nadu with a Ship To

address of the final Consignee in West Bengal. For this Invoice, an E-Way

bill must be generated with Consignor as the Bihar person and Consignee as

the Tamil Nadu person.

Second, the Tamil Nadu person (Bill-To Party) will issue either a Tax

Invoice or a Delivery Challan to the West Bengal person (Ship-To Party).

The Place of Supply of this transaction is West Bengal. For this

transaction, an E-Way bill must be generated with Consignor as the Tamil

Nadu person and Consignee as the West Bengal person.

Note that the actual movement of goods is from Bihar to West Bengal.

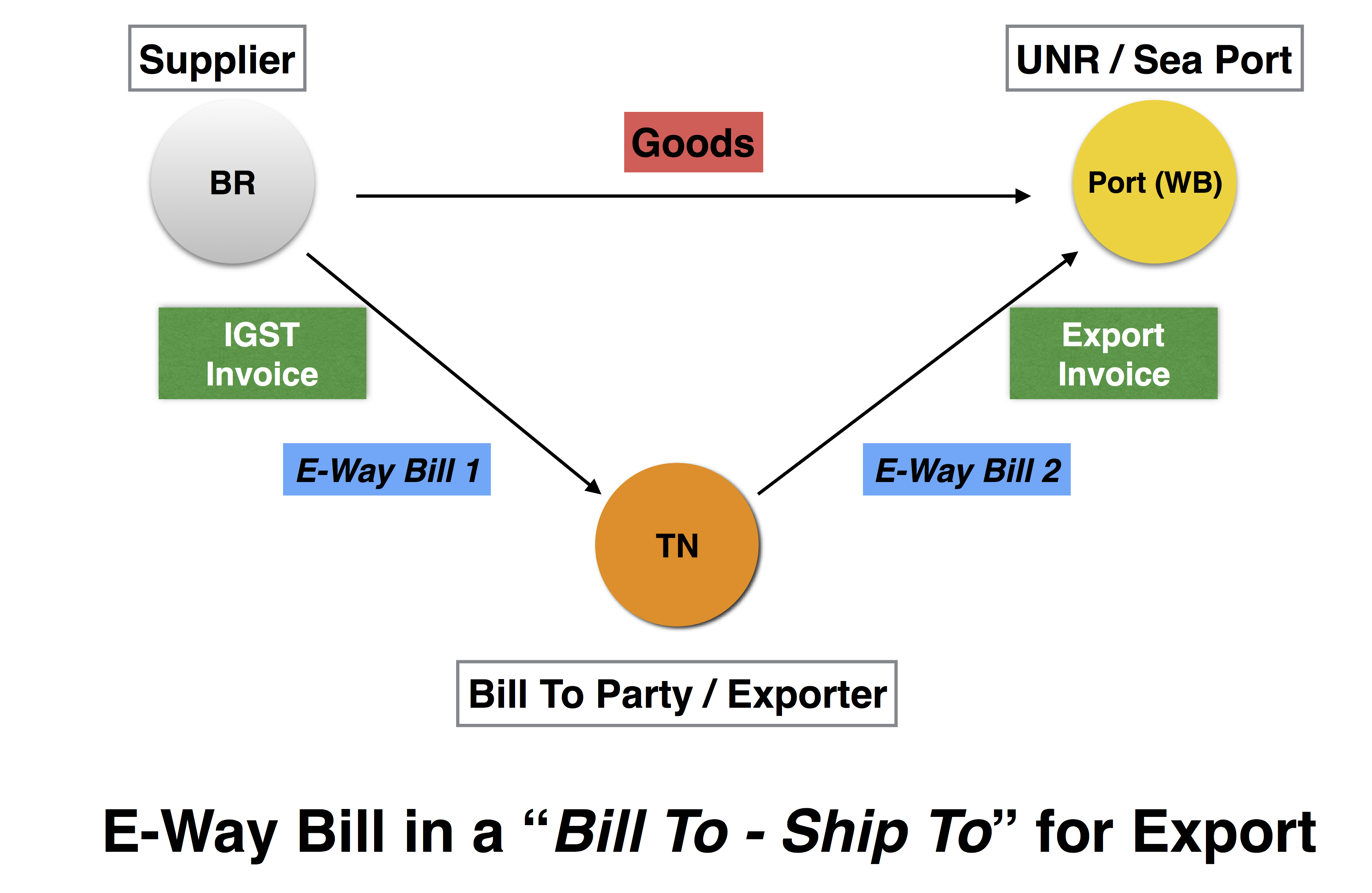

How are E-Way Bills generated for movement of goods in a “Bill-To Ship-To” export transaction? As an example, say a Registered Supplier in Bihar is Billing to a Recipient in Tamil Nadu and Shipping to a port in West Bengal for export outside India. What should be done in this situation?

Two E-Way Bills must be generated in this situation.

First, the Bihar Supplier will issue an Inter-State Tax Invoice (IGST) to

the Tamil Nadu Recipient with Place of Supply Tamil Nadu with a Ship To

address of the final Consignee in West Bengal. For this Invoice, an E-Way

bill must be generated with Consignor as the Bihar person and Consignee as

the Tamil Nadu person.

Second, the Tamil Nadu person (Bill-To Party) will issue a Zero-rated

Export Tax Invoice to the person outside India.

For this invoice, an E-Way bill must be generated with Consignor as the Tamil

Nadu person and Consignee as Unregistered Person (UNR). The destination of

this E-Way Bill will be West Bengal sea port.

Note that the actual movement of goods is from Bihar to sea port in West Bengal.

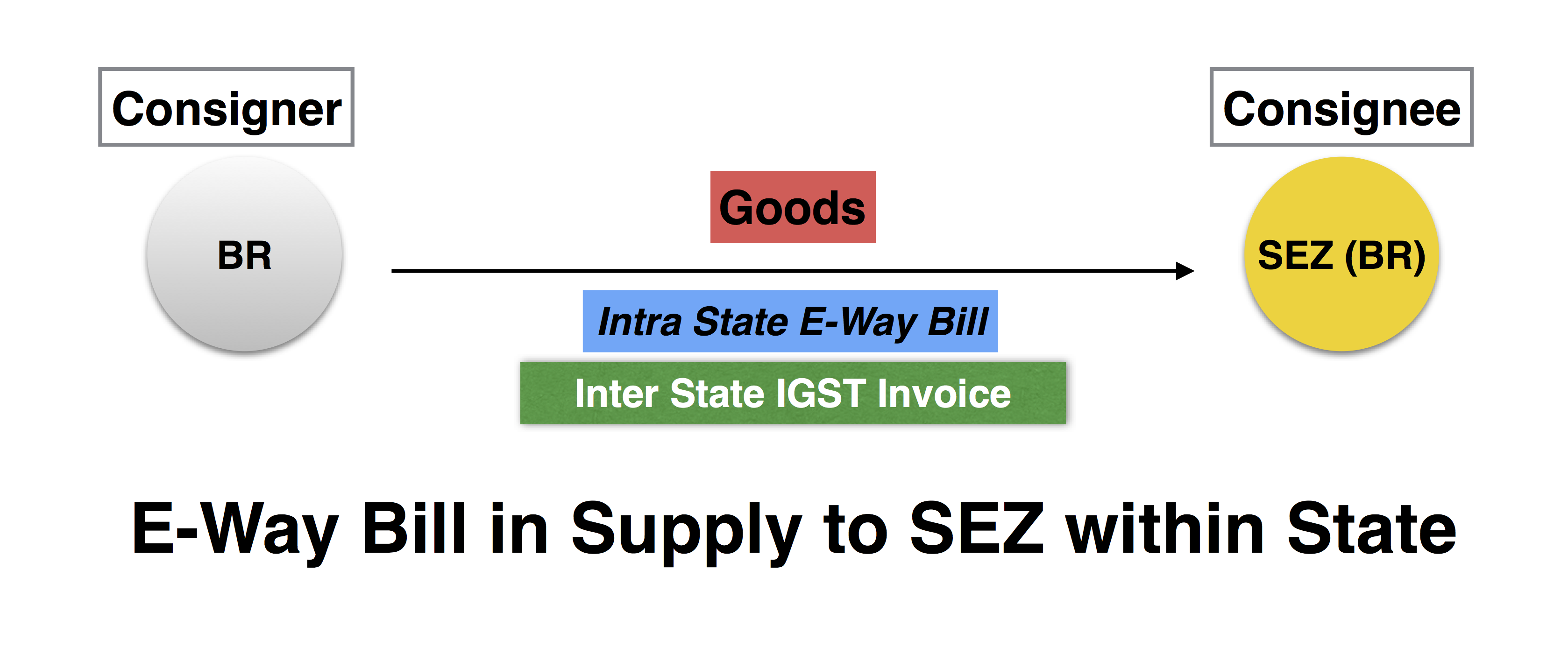

In the case of taxable supply to a Special Economic Zone (SEZ) within the same state, how should E-Way Bill be generated?

Supply to SEZ is considered Inter-State Supply under Section 7 of the IGST

Act. However, the movement of goods is Intra-State. E-Way Bill

does not concern the nature of supply, but only the type of movement.

E-Way Bill is needed in states that require E-Way Bill for Intra-State

movement. The list of 13 States as of Feb 1, 2018 is available

here.